Living Without Tax Stress: A Guide To Recovery and Renewal

Tax stress is a common concern that can weigh heavily on individuals and families alike, undermining financial stability and peace of mind. Complex tax regulations, the fear of audits, and the worry of incurring debt with the IRS can lead to significant anxiety. Yet, it’s possible to navigate these waters successfully and reclaim a sense of control over your financial life. This article aims to shed light on strategies to manage and alleviate tax stress. Keep reading to discover how you can foster a more serene and informed approach to handling your taxes.

Understanding the Roots of Tax Stress and Its Impact on Well-being

Tax stress often arises from confusion about tax laws, tight deadlines, and financial pressures. Misunderstandings about the process can fuel anxiety, while the fear of mistakes or penalties makes the season even more overwhelming. These worries don’t just affect finances—they can also trigger health issues like headaches, insomnia, and weakened immunity, making it harder to manage responsibilities effectively.

The strain of tax obligations can also impact relationships, with financial uncertainty leading to tension and conflict at home. Addressing these challenges starts with recognizing the root causes and seeking solutions, whether through better planning, reliable resources, or professional help, such as exploring options for tax settlement near me to ease the burden.

Navigating the Maze of Tax Compliance with Confidence

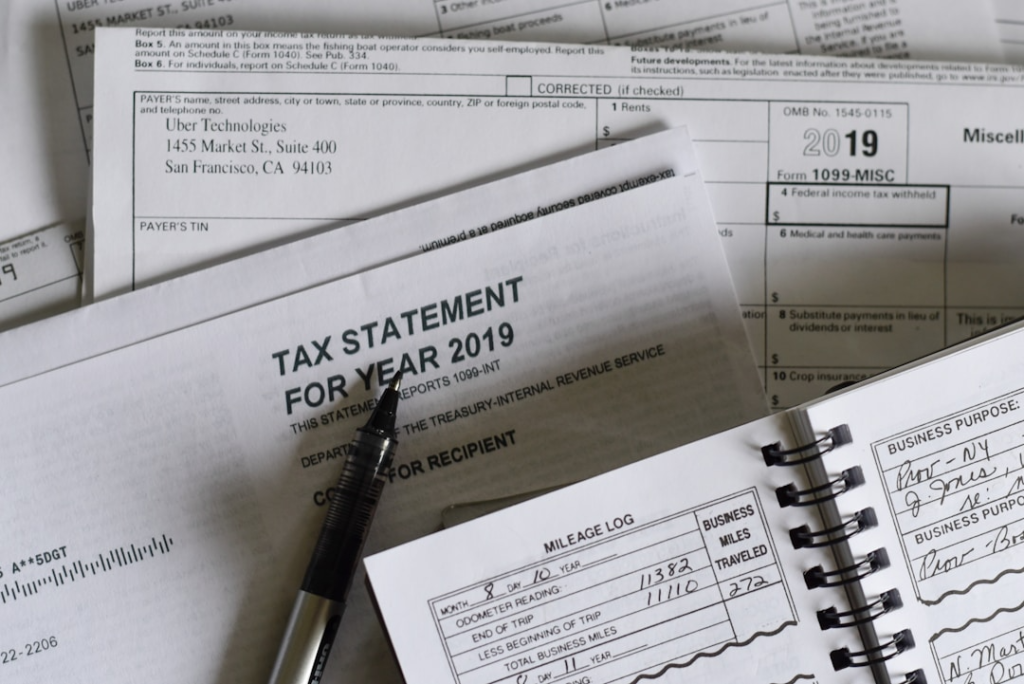

Understanding tax obligations and staying updated on changing laws are key to reducing stress and ensuring compliance. Keeping organized records and managing documents throughout the year makes filing more efficient and prevents last-minute pressure. Breaking the process into smaller tasks and setting reminders for deadlines allows you to handle tax preparation methodically rather than reactively.

Professional guidance can also simplify complex areas such as self-employment or investment taxes. Expert advice ensures legal compliance while helping optimize outcomes. Planning by setting aside funds for payments or preparing to use refunds wisely further strengthens financial stability. Taking a proactive, informed approach transforms tax season from a stressful obligation into a manageable, confidence-building process.

See also: The Future of Global Payments for Growing Businesses

Strategic Tax Planning: Proactive Measures for Long-Term Relief

Strategic tax planning is about managing finances with foresight to reduce liabilities and stress. It involves using deductions, credits, and tax-efficient investments while ensuring withholding aligns with actual obligations. Key tactics include retirement contributions for both future security and immediate tax relief, timing asset sales to manage capital gains, and charitable donations that benefit both taxes and philanthropy. Each decision builds toward a stronger financial position.

Life changes like marriage, parenthood, or career shifts can significantly impact taxes, requiring adjustments to strategy. Income fluctuations, new dependents, or relocation often call for tailored planning. While some handle this independently, many benefit from professional guidance to identify savings opportunities, stay compliant, and navigate complex rules with confidence.

Embracing Technology: Tools and Apps for Efficient Tax Management

The digital age has reshaped tax management through software and mobile apps that simplify filing and improve accuracy. These tools guide users step by step, automate calculations, and highlight potential deductions or credits, helping taxpayers reduce liabilities. Mobile apps also make it easier to track expenses, store receipts, and manage financial transactions, which is especially valuable for freelancers and small business owners who need precise records.

Cloud-based solutions add another layer of efficiency by securely storing and organizing tax-related documents for easy access anytime, even during audits. Most platforms emphasize strong encryption and privacy protections, giving users confidence in managing sensitive financial data. Leveraging these technologies allows taxpayers to stay organized and reduce stress during tax season.

The Power of Professional Help: When to Seek Tax Advisory Services

Certain tax situations, such as owning a business, investing in property, or handling inheritance taxes, often require professional guidance. A tax advisor can identify strategies to reduce liabilities, ensure compliance, and provide clarity when unexpected issues—like IRS notices or debt—arise. Searching for a tax settlement, for example, can connect individuals with professionals who help navigate complex financial challenges.

Even simple tax cases can benefit from expert advice during major life changes or when new tax laws take effect. Contrary to the belief that only the wealthy need advisors, people across all income levels can gain from personalized guidance. The value lies in reducing uncertainty, managing risk, and relieving the stress tied to tax obligations.

Overall, the journey to living without tax stress involves educating oneself on tax laws, leveraging technology for efficient tax management, and implementing strategic planning for long-term relief. By embracing these practices, you can navigate the fiscal sea with confidence, knowing that whether you opt for self-administration or professional guidance, serenity lies ahead.